1. The future value of a single cash flow.

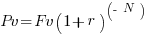

For yearly compounding:

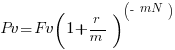

if compounding is more than once a year

For continues compounding

Where r = interest rate per period.

N= Number of the compounding period.

m= Number of compounding periods per year.

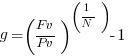

Effective annual interest rate:

2. Future value of a series of cash flows

Annuity: It is a finite set of fixed payments over a period of time.

An ordinary annuity is an annuity whose payments are made at the end of each period (t = 1)

An annuity-due is an annuity whose payments are made at the beginning of each period. (t = 0)

Future value of annuity

![Fvn = A[((1+r)^N -1) /r] Fvn = A[((1+r)^N -1) /r]](https://mahesht.com/wp-content/plugins/wpmathpub/phpmathpublisher/img/math_978_6c343a313c87606d3029018af771eb3e.png)

3. Present Value of Single Cash Flow

![Pv = Fv[1/(1+r)^N] Pv = Fv[1/(1+r)^N]](https://mahesht.com/wp-content/plugins/wpmathpub/phpmathpublisher/img/math_971.5_ff84d0959f023a9d77441a8af22fac9b.png)

which is equivalent to

With Frequency of compounding

4. Present value of series of cash flows

![Pv = A[ (1 - 1/(1+r)^N)/r] Pv = A[ (1 - 1/(1+r)^N)/r]](https://mahesht.com/wp-content/plugins/wpmathpub/phpmathpublisher/img/math_982_2a5cfa56920810e27573fdecd34ebc3a.png)

which is same as

![Pv = A[ (1 - (1+r)^(- N))/r] Pv = A[ (1 - (1+r)^(- N))/r]](https://mahesht.com/wp-content/plugins/wpmathpub/phpmathpublisher/img/math_982_325edc65d87a571971e14797d994b641.png)

5. Growth rate which is same as interest rate